Since the past decade, India's digital payment scenario has undergone a remarkable transformation. In the fiscal year 2022 alone, the total number of digital transactions surged to 8.84 billion, surpassing a cumulative value of Rs. 3 trillion.

Under the leadership of the Modi government over the past decade, there has been unprecedented growth in the adoption of debit cards, credit cards, and UPI/retail digital transactions. Comparing the period from 2014 to 2024, RuPay cards, which were non-existent a decade ago, have now captured approximately 80% of the debit card market share.

In tier-II cities and beyond, RuPay dominates both credit and debit card issuance, accounting for over a third of the market share.

The number of credit card users has quintupled from 20 million in 2014 to 100 million in 2024, while UPI users, which were nonexistent in 2014, now stand at 450 million. Retail digital transactions have surged by 90 times since 2014.

This change envisages a nation where smartphones redefine commerce, digital transactions supplant physical currency and financial inclusion becomes tangible.

At the core of this shift are two vital elements: UPI and RuPay credit cards.

Evolution of UPI and RuPay credit cards

UPI, introduced in the year 2016, consolidates multiple bank accounts into a single mobile app, facilitating seamless fund transfers and merchant payments. With a pilot launch and subsequent availability on the Google Play store in August 2016, UPI transactions are secured with PINs and robust encryption.

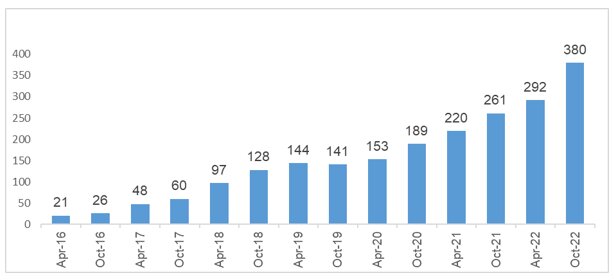

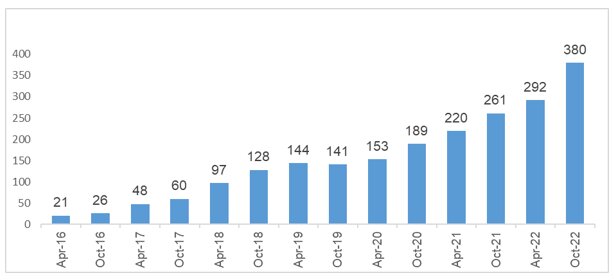

The chart presents surge in UPI adoption, Source: NPCI

RuPay credit cards, launched by NPCI in June 2017 offers a domestic alternative to international card networks, providing cost-effective solutions for domestic transactions.

Together, UPI and RuPay have revolutionized digital payments in India, making them more accessible, efficient and secure. These advancements reflect collaborative efforts among financial institutions, regulators and technology innovators in building a resilient digital payment ecosystem.

Drivers of Digital payment adoption in India

The recent upsurge in digital payments in India highlights the impact of technological advancements, forward-thinking regulatory actions, and changing consumer preferences. Below are the primary factors propelling the transformation of digital payments and factors contributing to the rise of RuPay cards in the country:

- Enhancing Financial Inclusion: The Rise of Jan Dhan Yojana

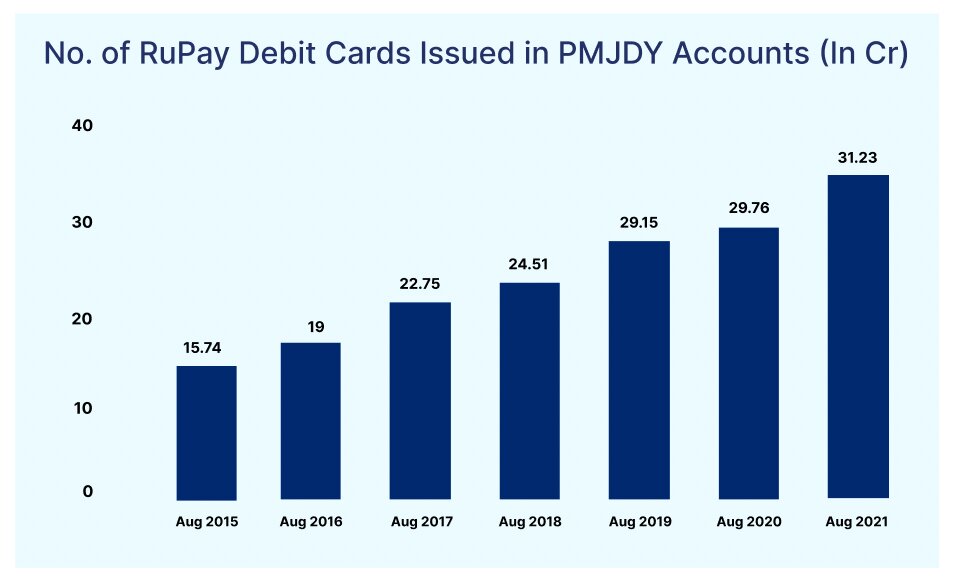

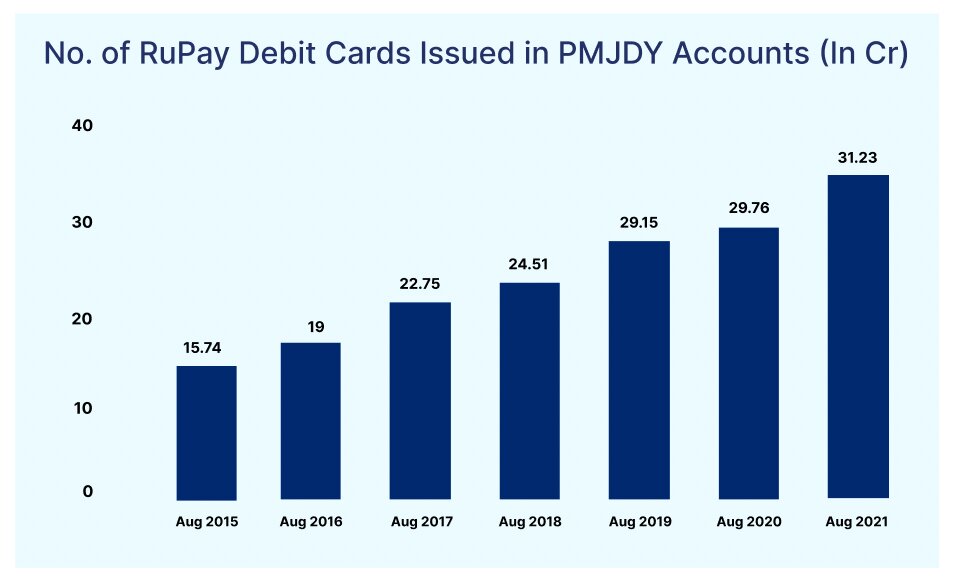

The chart represents no. of RuPay cards issued in PMJDY Accounts(in Cr), Source: Ministry of Finance

In 2011, almost half of the Indian population lacked bank accounts due to prohibitive minimum balance requirements ranging from 3,000 to 5,000 rupees, which were unattainable for the unorganized sector. To tackle this issue, the government launched the Jan Dhan Yojana in 2014, providing RuPay cards to new account holders as a means to promote financial inclusion.

2. Government Support is readily available

Visa's annual report highlights government mandates and regulatory requirements on international transaction processes as potential threats to their operations. Such regulations may hinder their competitiveness in markets like China, India, and Russia.

In response, the RBI established NPCI as a non-profit organization to develop a domestic payments and settlement system in India. With both the government and RBI aiming to enhance financial inclusion, NPCI serves as an ideal tool for prioritizing subsidized services.

3. Public Sector Bank Backing

With government intervention, all public sector banks (PSUs) exclusively issue RuPay cards to new customers. Reports indicate that the government has urged PSU banks to significantly increase the distribution of RuPay cards. Finance Minister Nirmala Sitharaman emphasized this directive at a bankers' conference in November 2020, stating, "RuPay card would have to be the only card you promote"

4. UPI's accessibility drives its popularity

The user-friendly design of UPI has been instrumental in its widespread adoption. Users can effortlessly link their bank accounts to create a UPI ID and conduct transactions with just a few taps on their smartphones. As of 2021, the number of UPI users in India surpassed 300 million, highlighting its simplicity and accessibility. By the conclusion of the fiscal year 2022, this figure skyrocketed to an impressive 450 million users, underscoring its sustained expansion.

5. Strengthened Security Protocols

UPI has implemented robust security measures such as two-factor authentication (2FA) and biometric verification, fostering trust among users. In 2021, UPI transactions witnessed a remarkable year-over-year growth of 88%, highlighting the confidence users have in its security features. By the conclusion of the fiscal year 2022, UPI demonstrated an even higher year-over-year growth rate of 95%.

Currently, UPI is operational in seven countries, with the list expanding nearly every month. These countries include Sri Lanka, Mauritius, France, UAE, Singapore, Bhutan, and Nepal. Bhutan stands out as one of the initial adopters of UPI payments beyond India, a move initiated in 2021 through collaboration with the Royal Monetary Authority (RMA) of Bhutan. Additionally, Bhutan has also emerged as one of the pioneers in embracing and issuing RuPay bank cards.

The journey towards a digitally empowered financial ecosystem is well underway, with continued collaborations and ongoing efforts to enhance accessibility, security, and convenience.